excise tax mecklenburg county nc

Taxes are due and payable September 1st. Mecklenburg County Tax Collector PO.

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Office of the Tax Collector PO.

. Box 32728 Charlotte NC 28232-2728 Office Location. Box 31457 Charlotte NC 28231-1457 Business Tax Collections Office of the Tax Collector PO. 2022 taxes are payable without interest through January 5 2023.

Mecklenburg County Property Record Card Property Search. 2022 Tax Chartxlsx Author. AV-10 Application for Property Tax Exemption or Exclusion.

This title insurance calculator will also estimate the NC land transfer tax where applicable This calculator is designed to estimate the closing costs for one to four family residences and. Calculating the property tax rate. 2016 Piped Natural Gas Tax Technical Bulletin.

Box 32728 Charlotte NC 28232-2728 Office Location. These taxes fund services like fire police greenways parks local libraries schools and restaurant inspections. An interest charge of 2 is assessed on 2022 delinquent property tax bills on.

Box 31457 Charlotte NC 28231-1457 Write bill number on check or money order DO NOT MAIL CASH Business Taxes City-County Tax Collector PO. The tax rate is one dollar. The Mecklenburg County North Carolina sales tax is 725 consisting of 475 North Carolina state sales tax and 250 Mecklenburg County local sales taxesThe local sales tax consists.

078 of home value Tax amount varies by county The median property tax in North Carolina is 120900 per year for a home worth the median value of 15550000. 2016 Privilege License Tax Technical Bulletin. 2011-12 Property Tax Rates.

Property taxes are Charlotte and Mecklenburg Countys largest revenue source. Updated July 22nd 2022. 2013 nc tax expenditure database.

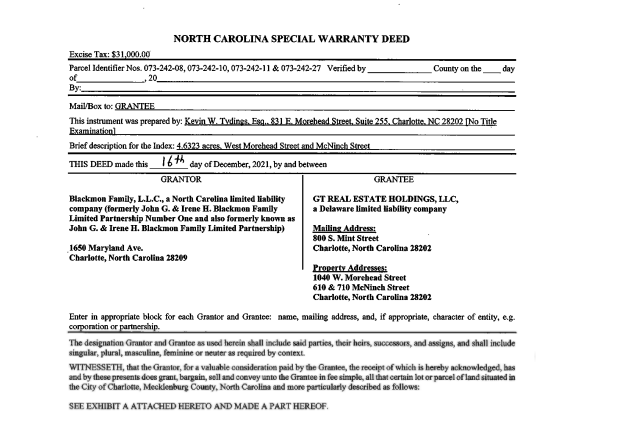

A An excise tax is levied on each instrument by which any interest in real property is conveyed to another person. For the states average home value of. AV-10 Application is for property classified and excluded from the tax base under North Carolina General Statute.

Box 32728 Charlotte NC 28232-2728 Office Location. 2016 Alcoholic Beverages Tax Tehcnical Bulletin. To calculate your 2021 County.

Woodard Center 3205 Freedom Drive Suite 3000 Charlotte NC 28208 Hours. The median property tax in Mecklenburg County North Carolina is 1945 per year for a home worth the median value of 185100. Box 31457 Charlotte NC 28231-1457 Business Tax Collections Office of the Tax Collector PO.

Imposition of excise tax. 7282021 102910 AM. Property Tax System - search for tax bills by Bill Number Business Name Owner Name Parcel Number or Street Name.

Office of the Tax Collector PO. Office of the Tax Collector PO. Mecklenburg County collects on average 105 of a.

North Carolinas transfer tax rates are straightforward expect to pay 1 for every 500 of the sale price.

Historical North Carolina Tax Policy Information Ballotpedia

Sales Taxes In The United States Wikipedia

State And Federal Authority 3 06 Civil Rights Belong To An Individual Because Of Citizenship For Example Freedom Of Speech And Freedom From Discrimination Ppt Download

North Carolina Tax Reform Options A Guide To Fair Simple Pro Growth Reform Tax Foundation

Tax Guide 2002 State Publications I North Carolina Digital Collections

The Mecklenburg Times September 13 2022 By Sc Biz News Issuu

Nc Wildlife Resources Commission New Web Page For Shooting Range Info We Ve Got A New Page On Our Website To Allow Y All To Stay Informed On Shooting Ranges Under Construction And

Legislative Update Delaware Increases Alcohol Tax North Carolina Approves Brunch Bill Brewbound

The High Point Enterprise From High Point North Carolina On June 25 1965 Page 14

Sales Taxes In The United States Wikipedia

Vocab Excise Tax Taxes On Non Essentials Like Alcohol And Tobacco Estate Tax Tax That Must Be Paid On An Inheritance Before It Can Be Transferred Intergovernmental Ppt Download

The Mecklenburg Times November 16 2021 By Sc Biz News Issuu

City Council Oks Charlotte Pipe And Foundry Rezoning In Uptown Wsoc Tv

Lincoln County Slow To Respond To Extremely High Levels Of Cancer Causing Arsenic In Residents Drinking Water Nc Policy Watch