are st jude raffle tickets tax deductible

The irs requires that taxes on prizes valued greater than 5000 must be paid. We will also notify each winner in writing by sending a Winner Notification Agreement WNA by secure electronic communication or certified US.

Dundee Ky Giving Away A 1950 Ford Custom Convertible

The IRS has determined that purchasing the chance to win a prize has value that is.

. The IRS does not consider raffle tickets to be a tax-deductible contribution. Yerba Buena Center for the Arts interpretation and application of the rules and regulations shall be. This is because the purchase of raffle.

The IRS requires that taxes on. You can make a tax-deductible donation to the Pet Association by. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

The Massachusetts sales tax is 625 of the sales price or rental charge of tangible personal property including gas electricity and steam and telecommunications services 1 sold or. A gift is a voluntary transfer of money or property where you receive nothing in return. Mail return receipt requested to the email.

They are allowed to hold raffles defined as an arrangement for raising money by the sale of tickets certain among which as determined by chance after the sale entitle the holders to. The gift must be made to a deductible gift recipient. Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization.

Jude dream homes benefits st. On October 31 2004 the drawing was held and Lou. Buy 1017 The Bulls Songs Stories To Benefit St.

The IRS considers a raffle ticket to be a. Raffle tickets are not tax deductible. As Brews Bites gets closer we are excited to announce our Getaway Raffle.

The gift must truly be a gift. Judes Hospital tickets at the Big Night Live in Boston MA for Nov 20 2022 at Ticketmaster. Raffle tickets are not deductible as charitable contributions for federal income tax purposes.

However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. Fails to withhold correctly it is liable for the tax.

St Jude Dream Home Winner Will Have To Pay Up To 180 000 In Irs Taxes

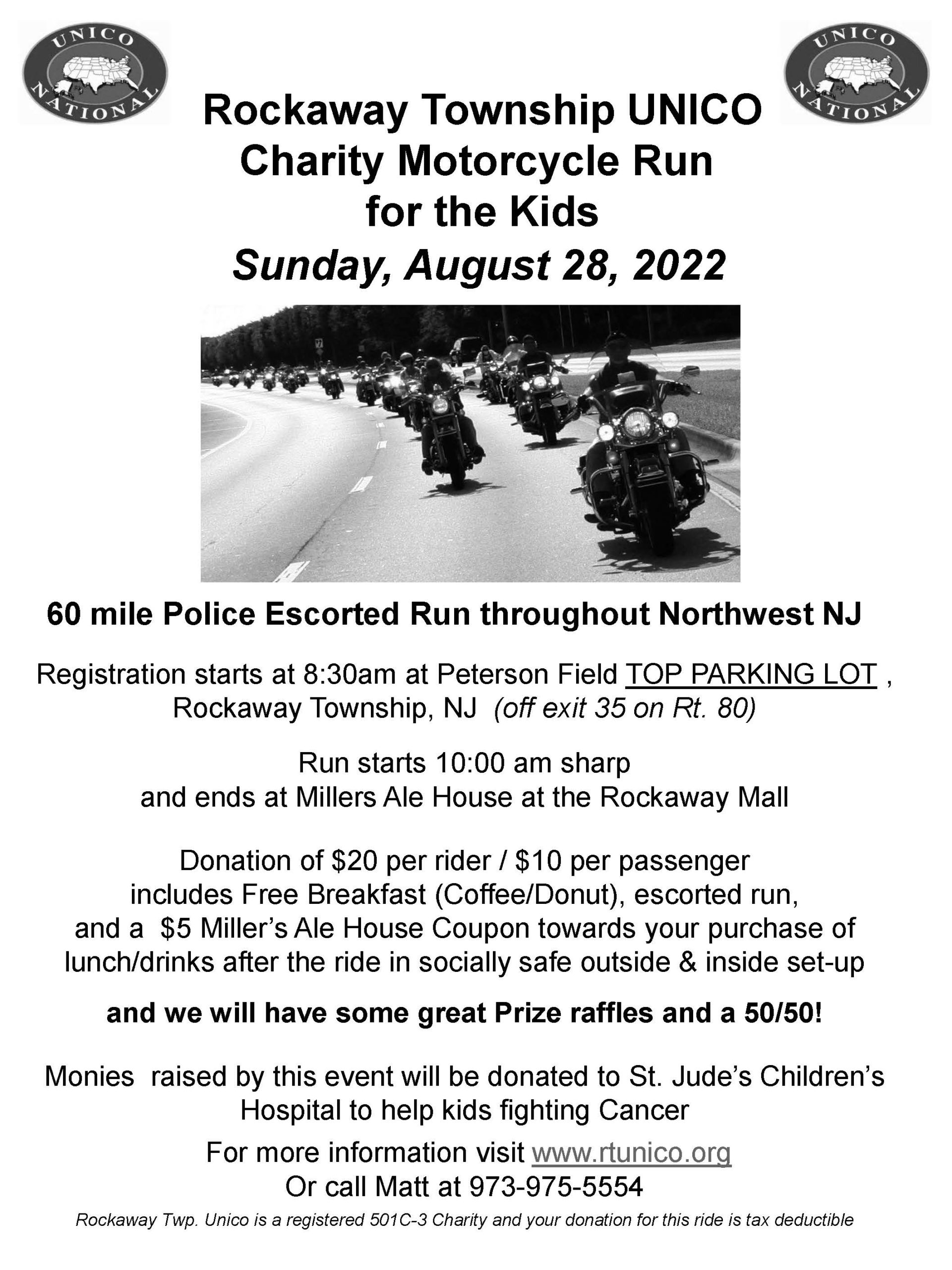

Rockaway Township Unico Charity Motorcycle Run For The Kids Laws 4 Hogs

Are Nonprofit Raffle Ticket Donations Tax Deductible

The Beacon The Beacon October 06 2022

Toast To St Jude Boston Home Facebook

Are Raffle Tickets Tax Deductible The Finances Hub

St Jude Dream Home Giveaway Tickets Sold Out

Dundee Ky Giving Away A 1950 Ford Custom Convertible

Why Do Grocery Stores Ask For Donations Tax Breaks

Fundraising Raffles Rules Regulations

St Jude Dream Home Tickets Sold Out

A 550 000 Home Raffle Ends With An Unfortunate Fortune Wfaa Com

Give The Gift Of Education Help St Jude Families Stjudeschool

Halloween Hotness Posts Facebook

Saint Joseph Church St Joseph Church Annual July Festival Carpinteria Ca

Faq 2022 Fall San Francisco Bay Dream House Raffle To Benefit Yerba Buena Center For The Arts